Unlocking Opportunities: CFM Indosuez's expertise in Private Equity

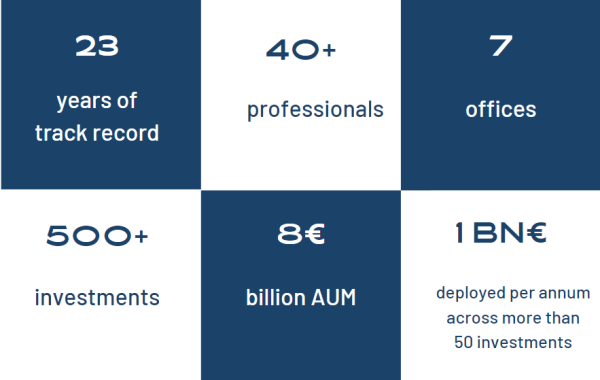

CFM Indosuez’s roots in private equity and private markets extends back to 2005. Our Private equity business has grown significantly since then and our extensive network, experience, and reputation in the market enable us to offer our clients carefully curated opportunities, tailored to their current and future needs in Private Markets.

Our three experienced local Private Equity advisors in Monaco can guide you in developing a personalised allocation and a diversified tailor-made Private Markets portfolio. Based on your investment profile and professional status, we can work with you to determine the right combination and balance of sub-asset classes and investment type that best align with your goals, risk tolerance and need for liquidity.

Source: Indosuez Wealth Management, data as of 30.06.2023

Why private markets and what are their benefits

Nowadays investors are looking beyond the traditional 60:40 equity/bond portfolio allocating more and more to private market. Private market investments provide investors a robust toolkit to diversify from traditional investments, offer differentiated sources of returns, and potentially help capture illiquidity premiums while mitigating systematic market. While one size does not fit all, high net worth investors often allocate 10 - 20% of their overall portfolio to Private Markets. That being said, institutional clients or single/ multi-family offices with significant resources and intergenerational time horizons could allocate 30% or more.

Our investment thesis

Private assets are a vast universe comprising a diverse range of asset classes that can cater for investors of all types. Our award winning offering* include private equity, private credit, infrastructure and real estate. Within Private Equity - CFM Indosuez specialise in mid-market buyouts and look to provide access to sought after and usually oversubscribed General Partners (GPs) in Western Europe, North America and OECD countries in Asia. The firm also sources exclusive co-investments alongside fund managers directly in both private companies and secondary opportunities.

Our network and due diligence

Navigating the Private Markets universe can be complex and requires in-depth understanding to gauge the risks and identify high-return potential opportunities. Our data, insight and expertise enable us to identify patterns that others might not see and factors that may prevent historical performance from repeating itself. Private equity have outperformed global public equity markets (figure 1), over the last 20+ years and given the larger dispersion of returns in Private Markets, manager selection is paramount (figure 2).

Figure 1: Buyout (Private Equity) - Total Return vs. Public Market Equivalent (PME) By Vintage Year

Source: Hamilton Lane Data via Cobalt, Bloomberg (August 2023)

We conduct rigorous selection and due diligence, covering investment, operational, qualitative, quantitative, strategic and legal aspects of the targeted funds and co-investments we select. The depth and breadth of our relationships and global network of circa 100 GPs allows us to provide clients with access to exclusive opportunities and usually better terms, which truly make us a partner of choice. Our investment team conducts ongoing monitoring and are active on 30+ Limited Partner Advisory Committees (LPACs) throughout the life of our funds.

Figure 2: Performance gap between top and bottom quartile funds (performance by asset class for 2011 -20 vintage funds, %)

Source: McKinsey& Company and MSCI Private Capital Solutions, McKinsey Global Private Markets Review 2024. IRR spreads calculated for separate vintage years for 2011–20 and then averaged out. Median IRR was calculated by taking the average of the median IRR for funds within each vintage year. Net IRR to date through Sept 30, 2023.Source: MSCI Private Capital Solutions.

CFM Indosuez product offerings and services have continuously evolved to bring innovative opportunities to our clients. Open-ended private market solutions, offers investors the flexibility of immediately accessing Private Markets and meeting their target allocation faster, without the traditional capital call process and illiquidity. This innovative approach seamlessly blends benefits of private market investments with the liquidity often associated with public markets**.

Talk to your advisor to discuss which Private Market investments may be right for you.

*Wealth briefing European Awards 2024

**For professional clients only. Investments may be subject to redemption limits. For detailed and contractual terms and conditions, please refer to the Private Placement Memorandum.

While the information herein and any opinion based thereon have been obtained from sources believed to be reliable, CFM Indosuez and/or Crédit Agricole Group affiliates do not represent that it is accurate or complete and do not accept any liability arising in case of error or omission. This document is for information only and is reserved for personal use. This is not intended for any particular investor and is not intended to be an offer, or the solicitation of any offer, to buy or sell the securities referred to nor a basis for an investment decision. Opinions, estimates and indicative prices are subject to change without notice. Any investment in private equity, direct or via a fund, is speculative by nature and carries significant risks. Investors must be prepared to assume these risks and to bear a total loss of the amounts invested. The investments mentioned herein are suitable for certain categories of eligible investors only in compliance with the relevant documentation. Before any investment decision, you must ensure that it suits to your own investor profile and objectives. Our Bank remains at your disposal for any further information. This document shall not be modified, reproduced or communicated.. »

June 11, 2024